when will capital gains tax rate increase

Capital Gains Tax Rate. Your 2021 Tax Bracket To See Whats Been Adjusted.

Capital Gains Tax What Is It When Do You Pay It

The maximum rate on long-term capital gains was again increased in 2013 from 15 in 2012 to 238 in 2013.

. Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized. In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married filing. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

Taxable income of up to 40400. In 1978 Congress eliminated. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million.

5 52021-2022 Long-Term Capital Gains Tax Rates Bankrate. Ad Compare Your 2022 Tax Bracket vs. Ad If youre one of the millions of Americans who invested in stocks.

Discover Helpful Information And Resources On Taxes From AARP. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. In a recent paper Huizinga et al.

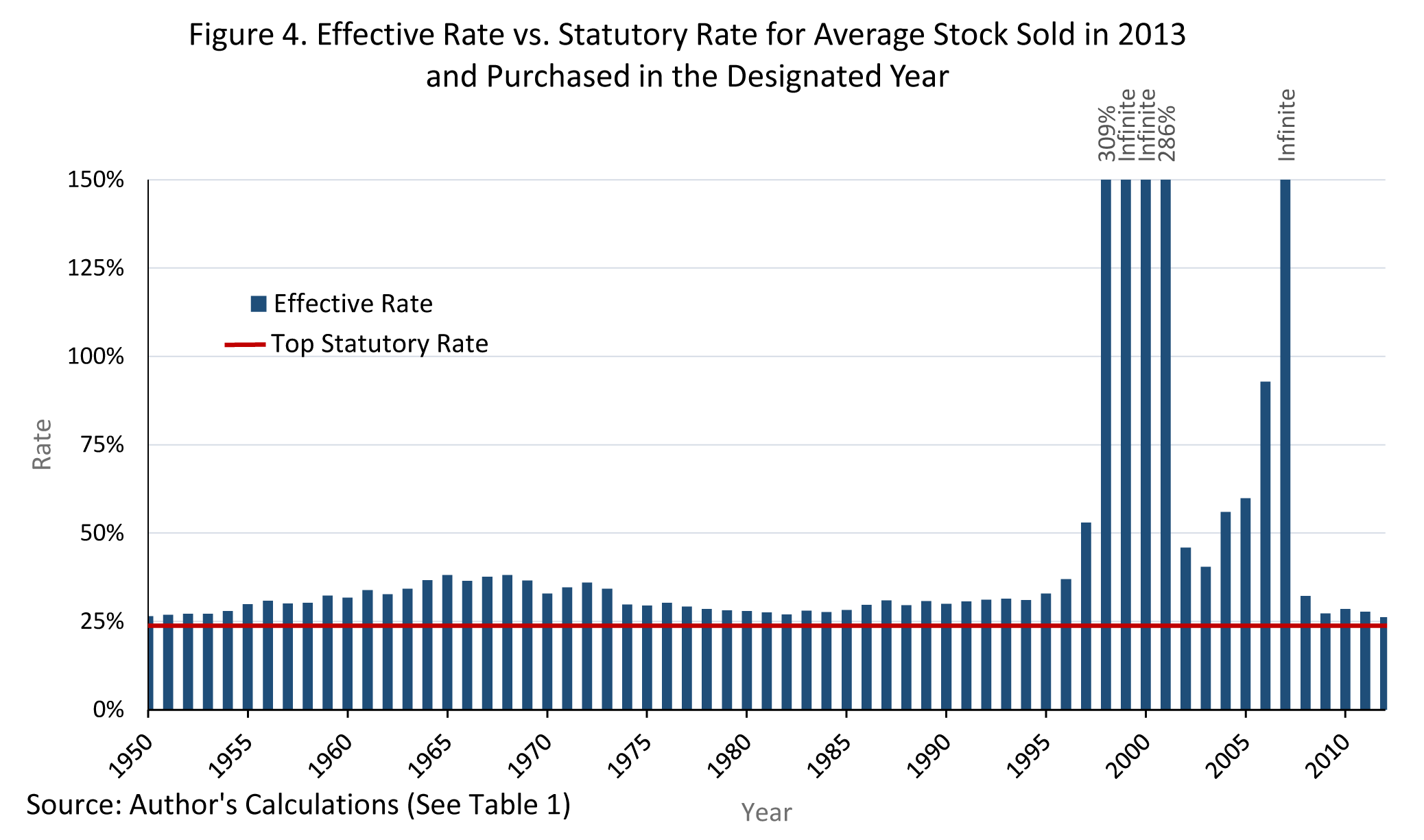

2021 Long-Term Capital Gains Tax Rates. September 15 2021 455 PM MoneyWatch. Thus the effective tax rate on capital.

This means youll pay 30 in Capital Gains. Everybody else pays either. Experienced in-house construction and development managers.

Experienced in-house construction and development managers. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. Above that income level the rate jumps to 20 percent.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. 2012 we estimate that the effective tax rate on capital gains amounts to 313 of the statutory rate.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. According to federal tax experts an increase in the capital gains tax isnt a question of if but when leading many business owners to look for an exit strategy in. The proposal would increase the maximum.

2 days agoThe capital gains tax rate is 0 15 or 20 on most assets that are held for longer than a year. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. Understanding Capital Gains and the Biden Tax Plan.

If you have the asset for a year or less it corresponds to ordinary income tax. Or sold a home this past year you might be wondering how to avoid tax on capital gains. The rates are much less onerous.

Collectibles such as art coins comics 28. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The expectation of this increase resulted in a 40 increase in.

The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35. The long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15 or 20 of the profit depending on the income of the filer. From 1954 to 1967 the maximum capital gains tax rate was 25.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Tax filing status 0 rate 15 rate 20 rate. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021.

Taxable part of gain from qualified small business stock sale under section 1202. For instance the top individual. The income brackets are adjusted.

Many people qualify for a 0 tax rate. Those with less income dont pay any.

What You Need To Know About Capital Gains Tax

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates Capital Gain Capital Gains Tax Income Tax Brackets

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

What You Need To Know About Capital Gains Tax

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Can Capital Gains Push Me Into A Higher Tax Bracket

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

It Task Force Proposals May Help Govt Save Inr 55 000 Crore Sag Infotech Capital Gains Tax Indirect Tax Task

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)